Wayne Whaley is co-owner, Chief Investment Advisor, and Head of Market Research for Witter & Lester, Inc., an RIA in Huntsville, Al. In 2010, his research paper "Planes, Trains and Automobiles" was recognized with a Charles Dow award by the Market Technicians Association (MTA) as the most important research of the year for his survey of various market thrust measures. Whaley writes weekly market commentary drawing ideas from a survey of dozens of the favorite models he has written over the last 30 years.

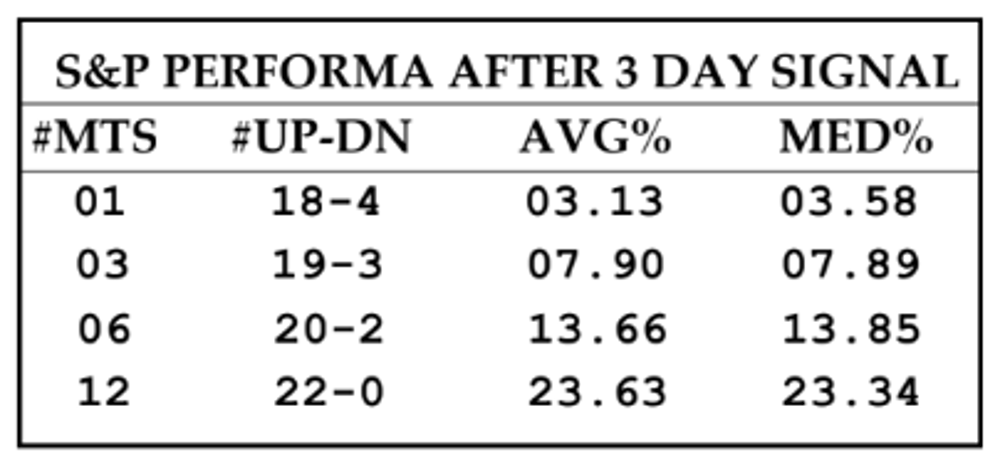

Wayne has a graduate degree in Operations Research from the Georgia Institute of Technology, in 1981. Given his educational background which is heavily steeped in Data Analysis Techniques, Design of Statistical Experiments, Optimization theory, and Mathematical Modeling, he takes a somewhat different and even unique approach to market analysis than most traditionally trained quantitative/technical analysts. His research approach is more oriented toward asking the computer questions, letting the computer research the item of interest, and providing him with the answer. For example, he once asked his computer what is the most bullish 3-day pattern of S&P price action over the last 50 years. The computer spent several hours scanning all combinations and responded that when the S&P posts a +3% day, followed by two consecutive positive days, the forward performance is as shown to the right. He maintains similar models for 4, 5, 6, and 9-day evaluations.

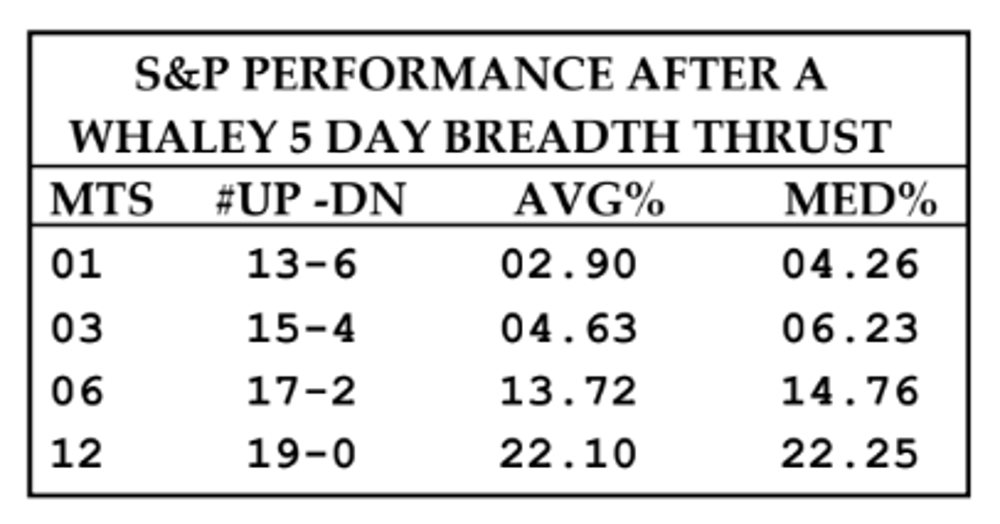

In the mid-1980s, Wayne was first introduced by Yale Hirsch to the theory that ‘As January Goes, So Goes the Year’. In 2012, he chose to evaluate for his own interest, all twelve calendar months' ability to forecast the following years' S&P direction. He discovered that, as he had anticipated, Hirsch was on top of the fact that January was a cut above any of the other eleven calendar months in terms of S&P one-year forecasting acumen. But while in seasonal barometer research mode, he then chose to remove the calendar month constraint from the initial scan and turned his computer loose on all 30,744 time frames across the year ranging from one week to three months in search of which period’s behavior was proprietor of the highest correlation coefficient relative to the following year’s S&P performance. He eventually did similar for the best two, three, and four periods and now has five of those models which he relies upon for Turn of the Year (Toy) Seasonal guidance. For example, the simplest of the five models is an evaluation of the two-month time frame Nov 19-Jan 19. The scan informed Whaley that if this time period (which he calls Toy2mt) is greater than 3%, the following year Jan19-Jan19 is 35-2 for an avg gain of 16.5%. And if Toy2mt is negative, the following year is 6-11 for an avg loss of 4.2%. The other 4 Toy models, which he reports on in his weekly commentary, have even more aberrant forward behavior. As of mid-January 2023, Whaley’s name was popular on the financial pages (google Whaley Five Day Breadth Thrust) as one of the signals from his 2010 Charles Dow PTA paper triggered, signaling a thrust alert. Whaley noted in 2010 that when the sum of daily advances over a 5-day period on the NYSE Composite index comprised at least of the issues traded over that time frame that the S&P had a very strong performance record over the following year as presented on the left.

Whaley relies upon easily over 10,000 lines of self developed computer code to aid him in his search each day for interesting

trading angles. The models rely on their ability to take an electronic snapshot of various indicator’s characteristics,

identifying all similar instances in the past and summarizing any aberrant results for the user, an approach many have come

to label as pattern recognition.

In 2015-16, Wayne converted, what he considers to be the best of his S&P models to a daily evaluation of fourteen different

market indexes including bonds, metal, currencies, energy and agricultural, and he is coming to terms with the fact that his

20 years of S&P research may have simply served as a training ground for what he expects to do in a more diversified, multi

market, research approach over the next decade. Wayne suggests that having a better feel for the whole Ball of Wax has

enhanced his ability to analyze and trade the S&P.

Wayne enjoys spinning a tale and confesses that 20 years of reading Alan Abelson in the 80-90s probably influenced his

writing style. He has been published in all the usual suspects, is widely circulated in cyber space and his weekly

commentary is available per subscription. Email Wayne at waynewhaley.witterlester@gmail.com for more information.